Insurance Application Testing: Guide & Best Practices

Learn with AI

The insurance industry was once deemed reluctant to change due to its outdated, heavily regulated system. However, the expectations for insurance software have changed. We are witnessing a digital transformation in the industry.

Insurance companies now improve customer experience and stay competitive through top-notch insurance software quality. The adoption of these new tech brings in the need for rigorous insurance application testing.

Let's dive in!

Importance of insurance application testing

The insurance industry itself is vast, including P&C insurance, health, car, life, and more.

No matter which area, a software bug or system failure can potentially result in significant financial losses, damage to reputation, and even legal liabilities.

That's why it's important to implement insurance application testing as a quality gatekeeper for the insurance software development process.

Automation testing further boosts the insurance software’s performance, reliability, and security. When app-breaking bugs are quickly found and resolved, your insurance software becomes more stable, gaining for itself a unique competitive edge in the marketplace.

📚 Resources: A Practical Guide to Automation Testing

Why centralized test automation is best for insurance

Many automation testing tools available on the market do streamline the testing effort. However, in reality, many teams struggle with the extensive configuration to connect those tools.

This is why teams need software quality management platform:

- Comprehensive quality management: We need end-to-end quality management, ensuring that all test activities, from planning, test creation, execution, to test management and test analytics are covered.

- Unification of testing activities: P&C insurance systems are really complex, consisting of web, mobile apps, policy management systems, and embedded devices. Each of them requires a different testing tool, leading to fragmented and inefficient testing processes. With a centralized insurance application testing platform, teams can test web, mobile apps, and even API, in 1 single place.

- Reduced maintenance and system configuration: With everything under 1 roof, maintenance efforts become more concentrated. This opens up resources to be re-allocated to other critical quality assurance areas.

- Centralized reporting: Business leaders need comprehensive actionable insights across the entire STLC to make data-driven decisions and provide visibility for multiple stakeholders. An end-to-end testing platform brings exactly that thorough kind of insight.

- Centralized planning and scheduling: Testing platform provides integration with popular DevOps tools, connecting teams involved in the project for better coordination, speeding up the feedback loop, allowing for continuous testing.

Adopting a software quality management platform is how insurance companies add another competitive edge to their services.

Here's an insightful webinar featuring QA leaders from SAGA and Katalon about how to do Software Quality for Insurance, which you may want to take a look:

How to test an insurance application

An insurance domain application consists of many subsystems, each performing a specific task. To achieve comprehensive quality, testers must check if these subsystems function well individually and as a unified entity.

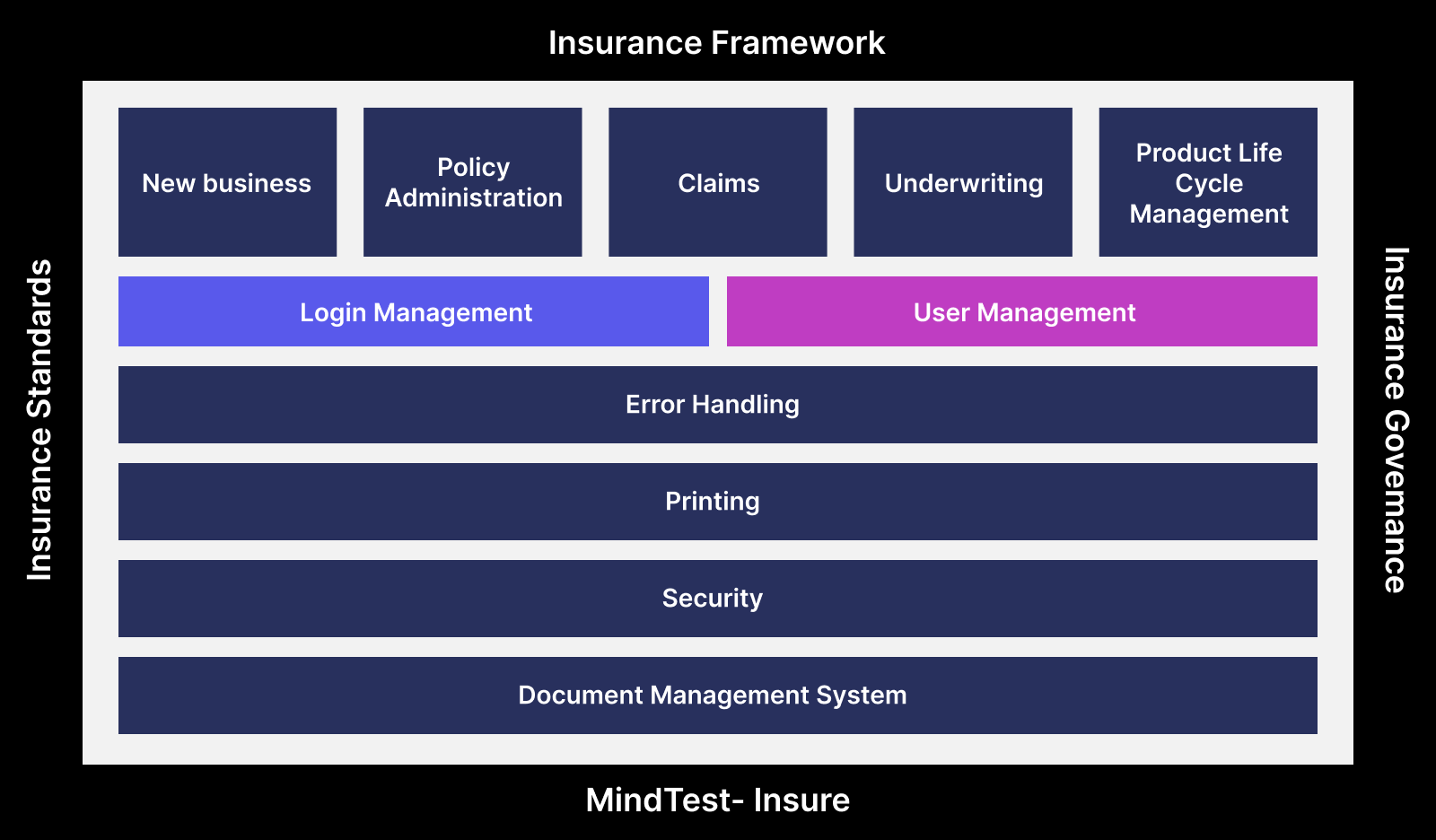

Framework of an insurance application

An insurance application is built on a framework including components, data flows, and communication protocols. This framework facilitates the connection between individual modules in the application. Below is an example of a typical framework for an insurance app:

Let’s examine how each framework of a P&C insurance software should be tested.

|

Module |

What to be tested |

|

New Business |

|

|

Policy admin |

|

|

Claims |

|

|

Underwriting |

|

|

Product life cycle management |

|

|

Error handling |

|

|

Printing |

|

|

Security |

|

|

Document management system |

|

Sample test cases for insurance application testing

|

Test Case |

Test steps |

Expected results |

|

User Registration |

Enter valid data in all mandatory fields and submit the form |

User account is created successfully |

|

Login functionality |

Enter valid username and password and click on the login button |

User is logged in successfully |

|

Policy creation |

Enter valid data in all mandatory fields and submit the form |

Policy is created successfully |

|

Policy cancellation |

Select a policy to be canceled, enter reason and submit the form |

Policy is canceled successfully |

|

Policy renewal |

Select a policy to be renewed, enter payment details and submit the form |

Policy is renewed successfully |

|

Endorsement processing |

Select a policy, make changes and submit the endorsement form |

Endorsement is processed successfully |

|

Claim submission |

Enter valid claim details and submit the form |

Claim is submitted successfully |

|

Claim processing |

Select a claim, review the details and approve or reject the claim |

Claim is processed and status is updated accordingly |

|

Premium calculation |

Enter policy details and verify the calculated premium amount |

Premium amount is calculated correctly |

|

User roles |

Verify that different user roles have appropriate access and permissions |

User roles have correct access and permissions |

|

Data validation |

Enter invalid data in mandatory fields and verify the error messages |

Error messages are displayed correctly |

|

Integration testing |

Test the integration of the insurance application with external systems |

Integration with external systems is seamless |

|

Performance testing |

Test the application performance under different load conditions |

Application performance is acceptable and stable |

|

Security testing |

Test the application security measures to ensure data protection |

Application data is secure and protected |

|

Compatibility testing |

Test the application compatibility with different browsers and devices |

Application is compatible with different browsers and devices |

|

Mobile App testing |

Test the mobile app version of the application |

Mobile app version is functioning correctly with no major discrepancy in the visual aspects |

|

Localization testing |

Test the application language support for different regions |

Application supports different languages and regions. No major layout impact when changing to other languages |

|

Reporting functionality |

Verify that the application can generate reports for various aspects of the insurance process |

Reports are generated accurately with all of the fields required |

|

Document management |

Test the application document management system for policy documents and other important files |

Documents are uploaded and managed correctly |

Quality assurance for insurance best practices

1. Leverage data-driven automated testing

In Property & Casualty (P&C) insurance, premiums are influenced by claim frequency and severity, which depend on numerous variables, like driver age, location, vehicle type, past claims, and coverage options. The sheer volume of combinations makes manual testing impractical and error-prone.

Data-driven testing solves this by allowing testers to:

-

Systematically validate premium calculation logic across a wide matrix of real-world risk profiles.

-

Identify edge cases or inconsistencies in rating engines.

-

Ensure accuracy and reliability at scale.

Here's an example of the steps you need to use data-driven testing to run premium calculation tests:

-

List input variables: e.g. age, ZIP code, vehicle value, claim history, etc.

-

Create test datasets: Input values + expected premium output.

-

Bind data to test scripts: Each row becomes a unique test case.

-

Execute & verify: Compare actual vs. expected premiums.

-

Analyze discrepancies: Adjust logic or flag rating errors.

With Katalon, you can easily integrate Excel, CSV, XML, or database files as your data sources. Its data binding feature streamlines execution across hundreds of scenarios.

2. Identify breaking points leading to system crashes and downtime with performance testing

During high-demand periods such as open enrollment, insurance applications often face a dramatic spike in user activity. Thousands of users may try to enroll in new policies or update existing coverage at the same time. Without preparation, this surge can lead to:

- System crashes

- Slow response times

- Complete outages

This is where performance testing becomes essential. It simulates large volumes of traffic under controlled conditions, helping teams identify bottlenecks, latency issues, and resource limitations before they affect real users.

3. Leverage integration testing to discover data inconsistencies

The policy administration system (PAS), claims management system (CMS), and the customer relationship management (CRM) system are among the most critical parts of an insurance software. Even if they work perfectly fine individually, bugs may still arise when they are integrated. Errors lie in the touchpoints between them, leading to data inconsistencies and operational inefficiencies.

For example, if a claims adjuster updates the claim status in the claims processing module but the billing module is not updated with the new information, the customer may receive an incorrect bill, causing confusion and frustration.The resources it takes to reverse these errors have bottom-line impacts. Integration testing verifies these interactions to ensure a smooth communication between modules.

4. Strategically Employ Test Automation

Start by identifying which parts of the testing process to be automated.

Repetitive tasks, such as regression testing or performance testing, as well as tasks that require a large number of test cases, are great candidates. After that, organizations should start evaluating available automation testing tools and frameworks to determine which is best suited.

Approach this from the build vs buy perspective: ask yourself if you should invest in building an automation testing framework from scratch or buying an automation testing tool with pre-built features.

5. Foster a culture of quality

The insurance industry values risk management, compliance, and customer service. Quality management is equally critical to ensure a smooth digital experience.

To support this, build a shared culture of quality across all teams, not just QA. Invest in tools that enable automated testing, code reviews, and continuous integration. Encourage user feedback to guide customer-centric, data-driven improvements.

QA leaders should champion this mindset by committing to quality, promoting continuous improvement, and recognizing those who drive it forward.

Insurance application testing with Katalon

As a comprehensive software testing solution, Katalon is the solution for P&C Insurance Software Companies wanting to upgrade their testing activities.

1. Cover all aspects of insurance software testing

With one single workspace of Katalon, testers can perform:

- Test planning

- Test authoring

- Test management

- Test execution

- Test analysis

You can effortlessly test insurance websites, mobile apps, APIs, and policy management platforms thanks to the low-code test creation capabilities. Team members with varied programming expertise can contribute to the testing effort. Katalon also supports visual testing.

Instead of spending hours manually reviewing screens and spot tiny visual bugs with our own eyes, testers can now leverage AI-driven visual testing to accurately detect visual changes that impact user experience.

2. Improved execution speed and agility

Katalon speeds up testing with self-healing, data-driven testing, parallel testing, and test artifact sharing across multiple teams and product lines. The platform also supports CI/CD pipeline integration for faster and more efficient deployment. After testing, you can export detailed reports, view analytics dashboard, and actionable insights to make timely data-driven decisions.

3. Global customer support

Katalon provides global customer support through various channels to help its customers through a ticket system. Customers can easily gain access to a large knowledge base at the Katalon Blog and product documentation.

At Katalon Community, you can find many quality professionals around the world discussing technical-related topics about testing on the Katalon Platform. Engagement level is high among community members, who are ready to offer support and provide answers to any questions you may have. Katalon has a dedicated Community team to regulate the forum, maintaining a healthy and collaborative culture.

|

FAQs on Insurance Application Testing

Why is insurance application testing so important?

Because defects can cause financial loss, reputational damage, and even legal liabilities, so testing acts as a quality gatekeeper for insurance software delivery.

Why do insurance teams benefit from a centralized test automation platform?

Insurance systems span web, mobile, APIs, policy/claims platforms, and more, so a centralized platform helps unify test activities, reduce fragmented tooling, lower maintenance/config overhead, and provide central reporting, planning, and scheduling.

What are the key modules to test in a P&C insurance application?

Common areas include New Business, Policy Admin, Claims, Underwriting, Product lifecycle management, plus cross-cutting concerns like Error handling, Printing, Security, and Document management.

What types of test cases are typically needed for insurance apps?

Examples include user registration/login, policy creation/cancellation/renewal, endorsement processing, claim submission/processing, premium calculation, role/permission checks, data validation, and broader integration/performance/security/compatibility/mobile/localization testing.

How does data-driven testing help in insurance (especially premium calculations)?

Premiums depend on many variables (age, ZIP, vehicle, claim history, coverage options, etc.), creating huge combinations. Data-driven testing lets you run hundreds of scenarios using datasets (e.g., Excel/CSV/XML/DB) and compare actual vs expected premiums at scale.

When should performance testing be emphasized for insurance systems?

During peak periods (e.g., open enrollment or traffic spikes) to prevent crashes, slow response times, and outages by identifying bottlenecks and resource limits before real users are impacted.

What’s the goal of integration testing in insurance platforms (PAS/CMS/CRM)?

To catch defects at system “touchpoints” that cause data inconsistencies and operational inefficiencies—for example, claim status updates not propagating to billing, leading to incorrect customer bills.